Blue Origin announced yet another project it had undertaken for its missions for space domination across all sectors. Called Terrawave, it will be a constellation of over 5,000 satellites designed to bring symmetrical, high-speed internet connections worldwide.

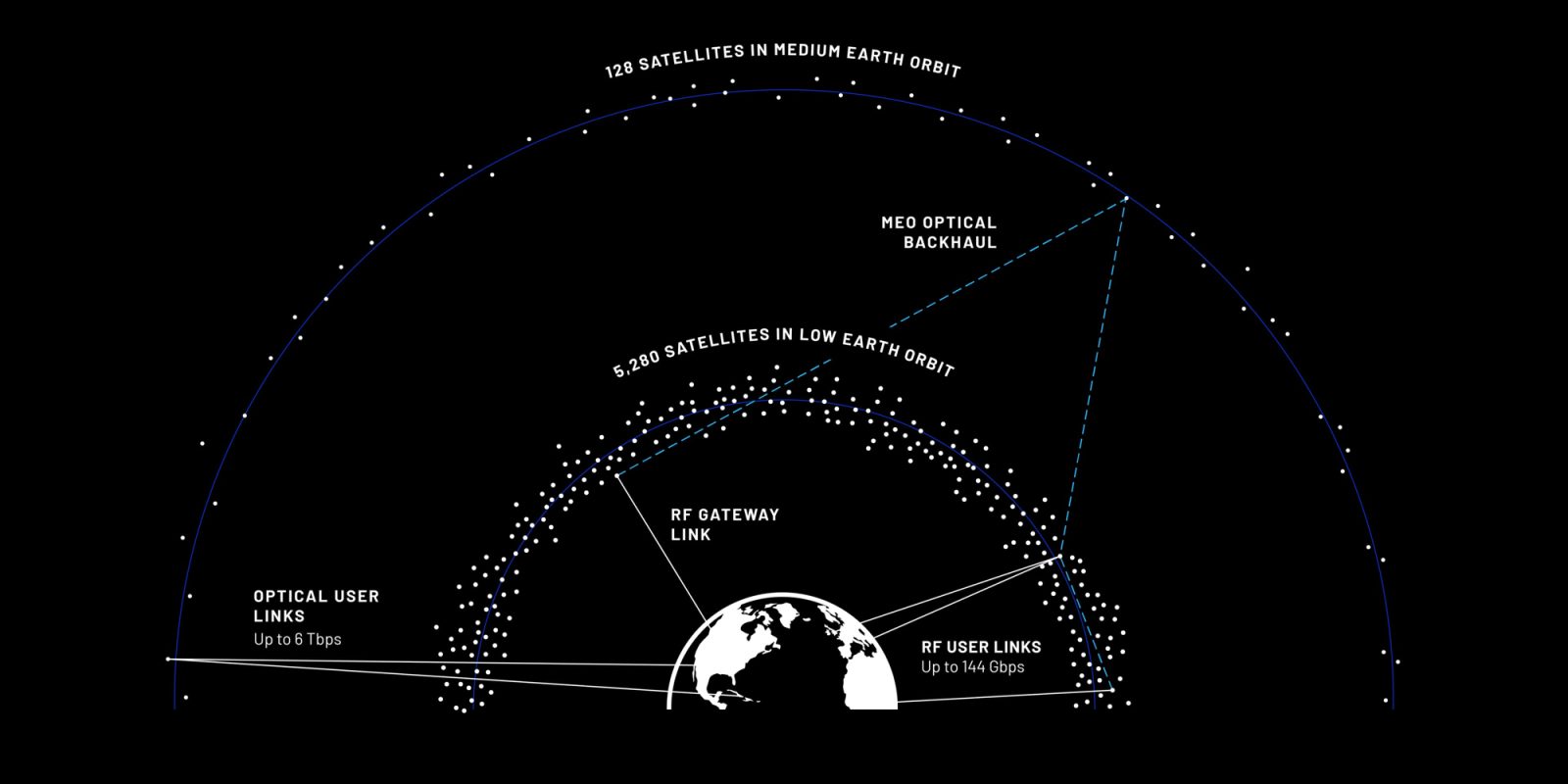

Blue Origin’s Terrawave will be split into two groups, 5,260 LEO satellites and 128 medium Earth orbit “backhaul” satellites. Boasting speeds of up to 144 Gbps, the LEO satellites would crush any competition currently in the market. Not to stop there, Terrawave’s MEO satellites are planned to operate around six Tbps to both Terrawave’s LEO satellites and ground customers.

While the LEO satellites will feature RF ground transmission with optical interlinks, the MEO constellation will be entirely optical, allowing for its impressive speed expectations.

Blue Origin shares of the MEO constellation could act as a “backhaul” for satellites, moving information from one side of the planet to the other at the blink of an eye, while LEO satellites handle the ground-to-space connection.

You may be thinking, “Wow, Blue Origin is really coming for SpaceX’s Starlink with those speeds.” Well, they’re not. Terrawave is marketed as an enterprise and government product, not a consumer product. Blue Origin’s market size is estimated to be around 100,000 customers compared to Starlink’s millions.

That lower customer size and specialized hardware (and likely much higher cost) will be a big factor in why its speeds can be so high. Terrawave won’t have any issues with a large number of customers in one region bottlenecking its bandwidth.

So who is Terrawave for? Data centers, governments, and other large corporations that need to move data around the globe at high speeds or with redundancy from ground wires. It would also be a useful backup in case of national disasters, giving those on the ground a steady and secure connection when landlines and cell towers are down.

Terrawave’s 5,000 satellites will join the tens of thousands of Starlink satellites and hundreds of OneWeb satellites that already orbit Earth providing similar services. That doesn’t include the other future constellations that want to have thousands of satellites for themselves; this includes Amazon LEO, Europe’s Iris2, and a Chinese Starlink alternative.

While this brings competition to the new frontier, it also increases the concerns of LEO becoming too packed. This makes Earth science observations harder, launching rockets more complicated, and raises the chances of in-space collisions.

Something that has potential fixes, yet it doesn’t seem to be moving as fast as the industry is launching new satellites.

Space Explored’s Take

While many will paint Terrawave as a competitor to Starlink, it is truly serving a different purpose. Jeff Bezos, founder of Blue Origin and Amazon, mentioned his goal with the company has been to build the infrastructure of space. Terrawave fits that mission, serving as an enterprise for businesses to use to build other products that consumers use, like Amazon AWS.

Who Terrawave will directly compete against is Eutelsat OneWeb, a long-time LEO constellation lurking in the background while Starlink takes the limelight. OneWeb already provides a similar service to enterprise customers but at much lower speeds, although we’ll see if Terrawave can live up to its lofty speed goals.

That doesn’t mean SpaceX couldn’t compete. Elon Musk has discussed higher speeds with future versions of its satellites. However, those will require Starship to become operational.

However, before any of this takes place, the company needs to get its New Glenn rocket to full speed. SpaceX’s biggest advantage is being able to launch its Starlink satellites in-house, ditching launch provider fees. Maybe that happens this year; at least I would expect New Glenn to launch more than it did last year.

FTC: We use income earning auto affiliate links. More.

Comments