Boeing, the once esteemed aerospace contractor has had its hands in almost every national space program since Apollo. However, it seems likely that the company wants to divest itself of almost all of its space programs.

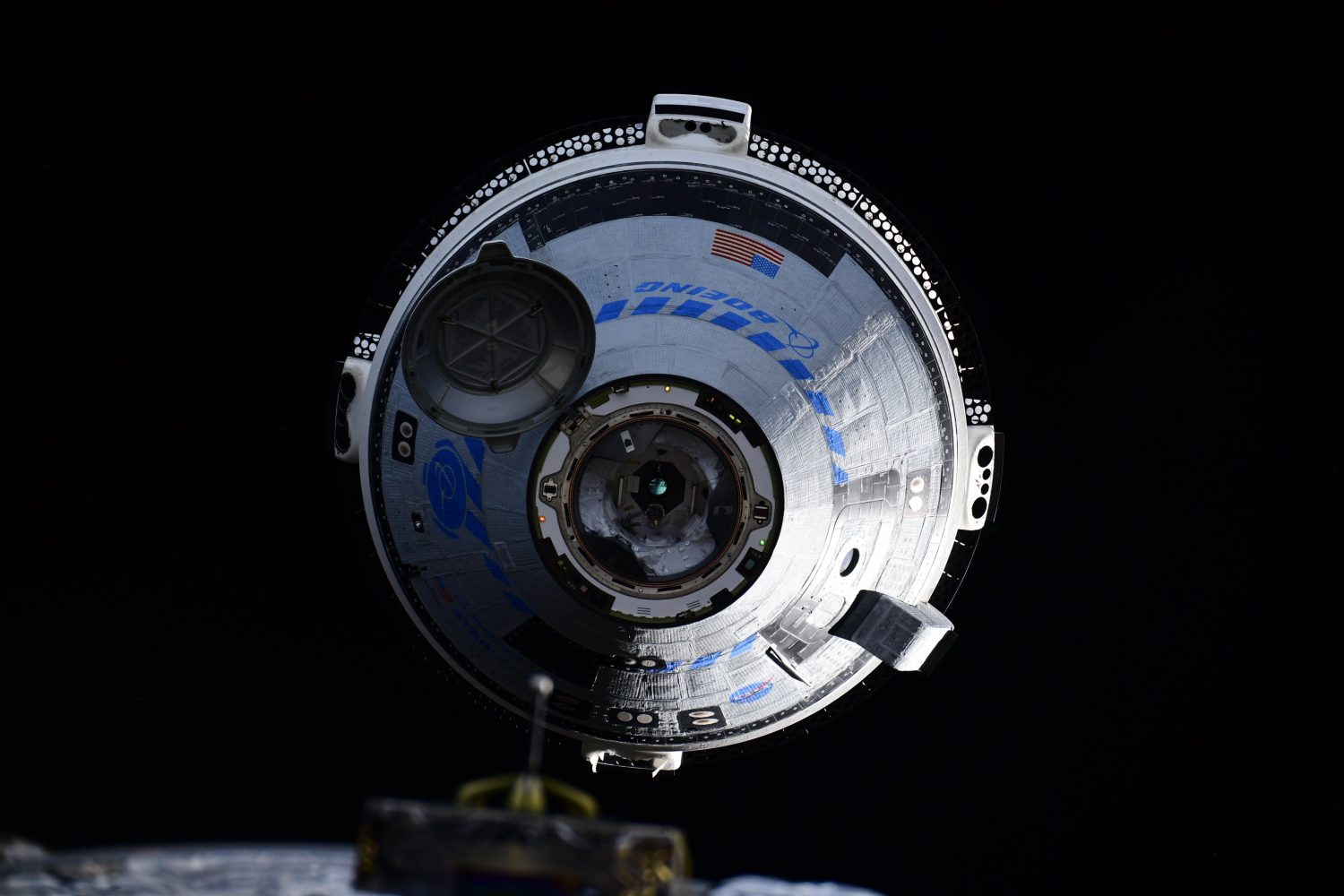

The Wall Street Journal reported that the company is looking for buyers for most of its space programs to better streamline the business and reduce its overall losses. While Starliner has been the main headliner in recent months, the company is also the prime contractor for the International Space Station, a major builder of defense and commercial satellites, commercial launchers through ULA, along with another significant project, NASA’s Space Launch System.

For now, the WSJ says the latter two are safe from being sold off. Both its defense satellite business and SLS program are huge pros for the company, both financially and politically. While it took the company many more years than planned to get SLS off the ground, now that it has gotten a launch under its belt, it seems ready to get its rockets delivered on time for future missions.

For Starliner and the ISS, the WSJ reported Boeing approached Blue Origin to offload its business onto. While the ISS business is a cost-plus contract under NASA, guaranteeing a profit, the lifespan of the station is nearing its end. Meanwhile, you could imagine under Boeing’s new leadership that space station building is not in its future; however, Blue Origin is greatly interested in operating future commercial stations.

Boeing’s Starliner program is an overall hot mess. After years of delays, billions of dollars, and a shaky crewed certification mission, its future for moving to operational use is still uncertain. Ars Technica reports on the ability for NASA to pay Boeing to launch an uncrewed cargo mission to the station to reduce its risk before certification. NASA’s need for another commercial supply is quite low; it already has SpaceX, Northrop Grumman, and soon Sierra Space to provide those services.

For now, Starliner’s earliest chance of launching its first operational crew is in 2026, four to five years before the planned retirement of the ISS. Blue Origin’s ownership of the program could bring new life into the management, speeding up timelines, especially if it can be adapted for use on the company’s New Glenn rocket.

Finally, Boeing and its partner Lockheed Martin have been exploring a sale of ULA for over a year. Blue Origin was another potential buyer alongside aviation company Textron and private equity firm Cerberus. Still, there are no new reports showing any company making bids or even still looking to buy.

ULA is likely one of the most valuable assets Boeing has; however, not for its rocket but for its defense launch contracts. ULA has long been the most trusted launch provider for NASA and the Department of Defense, bringing in billions of dollars in revenue from just a handful of launches a year.

Pair this with a commercially viable rocket to compete with SpaceX, and you have the ability to make some serious plays in the space launch market.

For now, these sales talks are in the early stages, and Boeing is still planning to support its obligations until sales are actually made, if they’re made at all. Boeing is in a tough spot; along with its less-than-successful space programs, its commercial and defense aviation division has also seen blunders in recent years. The new chief executive has his work cut out for him to swing this once-prime company around and hopefully return it to glory.

FTC: We use income earning auto affiliate links. More.

Comments